Bank Certificates vs Bank Statements - How to Get Bank Documents in the Philippines for Visa Applications

The most common visa requirement to prove the financial capacity of a person is through Bank Certificates and Bank Statements. You can get those thru you are going to any branch of your bank and ask for such documents. Most personnel will direct you to the counter for printing or would give you a queue number.

Photo by Stephen Phillips - Hostreviews.co.uk

Getting a Bank Certificate and Bank Statement is very easy; you need to know your account number and your name, go to the bank with a valid ID, pay, and you’ll have it!

Difference between a Bank Certificate and a Bank Statement?

A Bank Certificate is a confirmation by the branch manager or a bank officer that the person has an account in their bank. It shows the account number and type and other details such as the opening date of your account, your account balance as of the date of request, and your average daily balance.

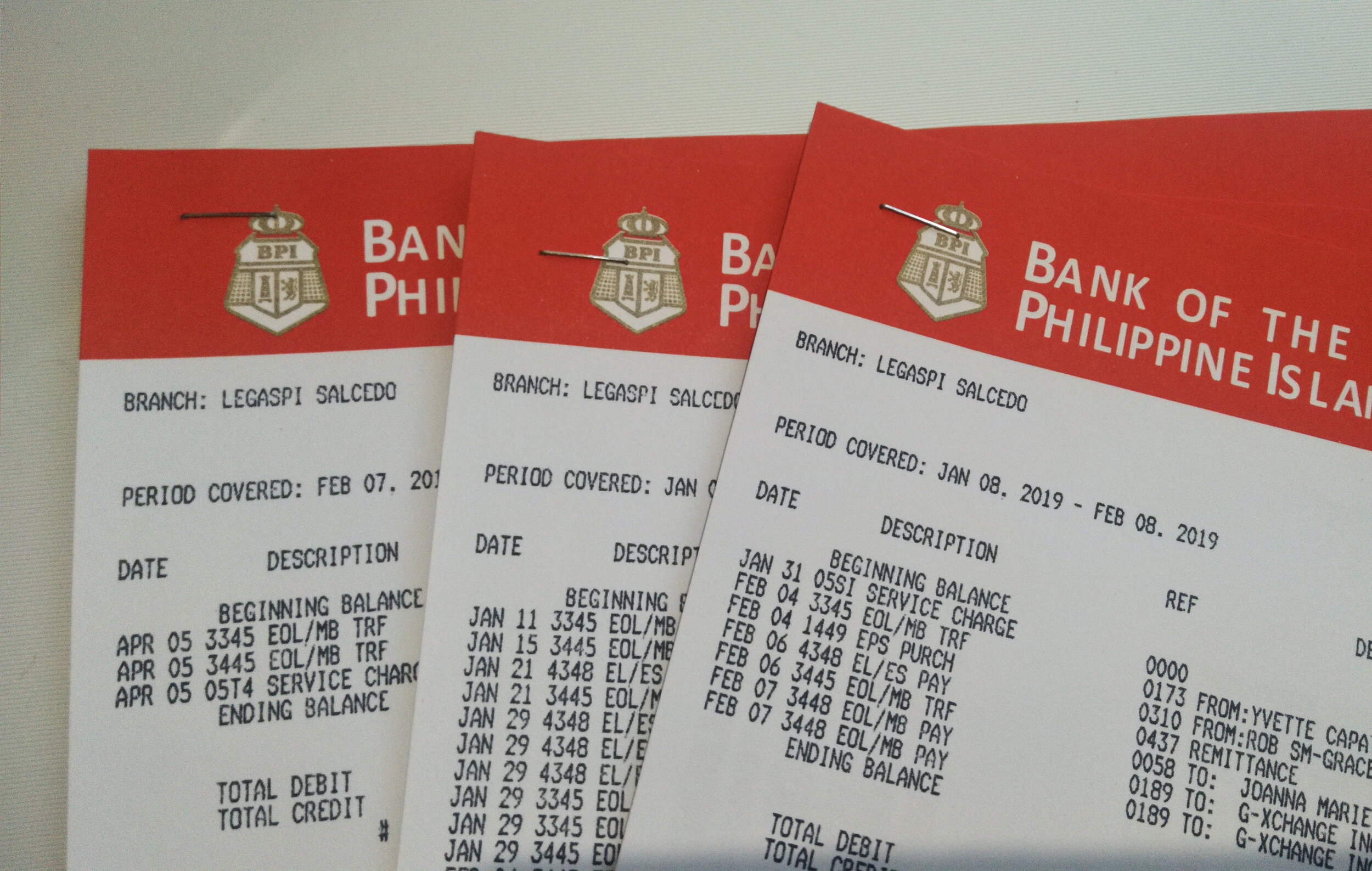

A Bank Statement shows your transactions in your account at a specific period. It will show debits (withdrawals, payments, taxes, service fees) and credits (deposits, interest earned.) Bank Statements can also be seen online especially if you have a registered account. There is no signature for the manager or a bank officer.

They are both different, and you should check what the visa requirement is if it is a Bank Certificate, a Bank Statement or both. You can get denied if you pass a Bank Statement, and the requirement is a Bank Certificate. So be careful with that.

How to get a Bank Certificate

Go to your bank – though some people like to go to the one where they opened it; you can go to a branch. They can access your account.

Tell the guard (because he’s near the door and knows the personnel and their assignments) that you want to get a Bank Certificate. He/She will give you a form to fill-up, point you to the correct person or give you a queue number.

Fill-up the Request Form. You will be asked the following:

The document you want (Bank Certificate)

Account Name

Account Number

Purpose of the document: Visa (specify the country)

What you want to be shown: Opening Date, Type, ADB (Average Daily Balance)

How you will be charged: either via Cash Payment or Charge to your account

Review the details you have written.

Give the form to the officer as well as your ID. S/he will ask then ask you for the payment or inform you that she will be charging your account.

Some banks like BPI – you only need to wait for a few minutes to get your Bank Certificate; other Banks you will need to come back the next day. It will be prolonged if the signatory is busy, so you have to wait a bit, and then you are done.

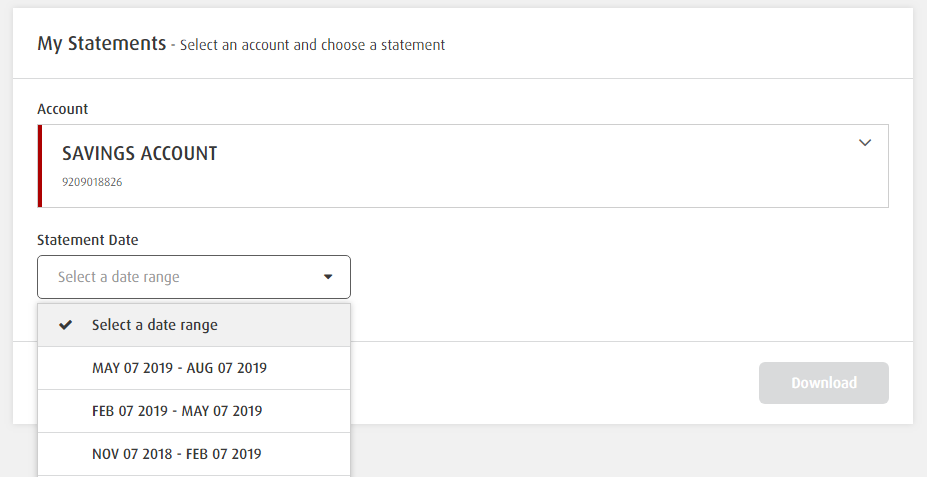

How to get a Bank Statement

Go to a branch of your bank.

Tell the guard that you want to get a Bank Statement. S/he will give you a form to fill-up, point you to the correct person or give you a queue number.

Fill-up the Request Form. You will be asked the following:

The document you want (Bank Certificate/Bank Statement)

Account Name

Account Number

Purpose of the document: Visa (specify the country)

Transaction dates e.g. 3 months (January – March 2019)

How you will be charged: either via Cash Payment or Charge to your account

Review the details you have written, check if it will be what the embassy specifies. Some will ask for 3 months, other months.

Give the form to the officer as well as your ID. S/he will ask then ask you for the payment or inform you that she will be charging your account.

Wait for your bank statements.

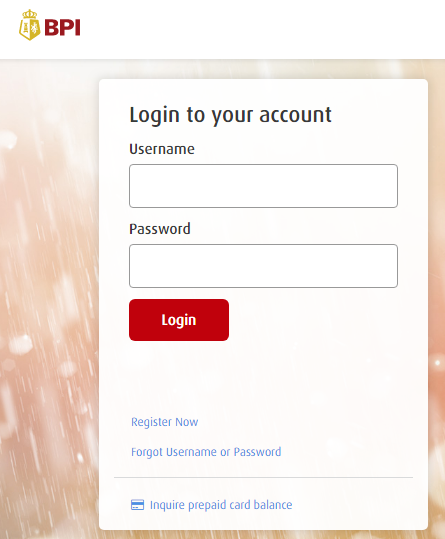

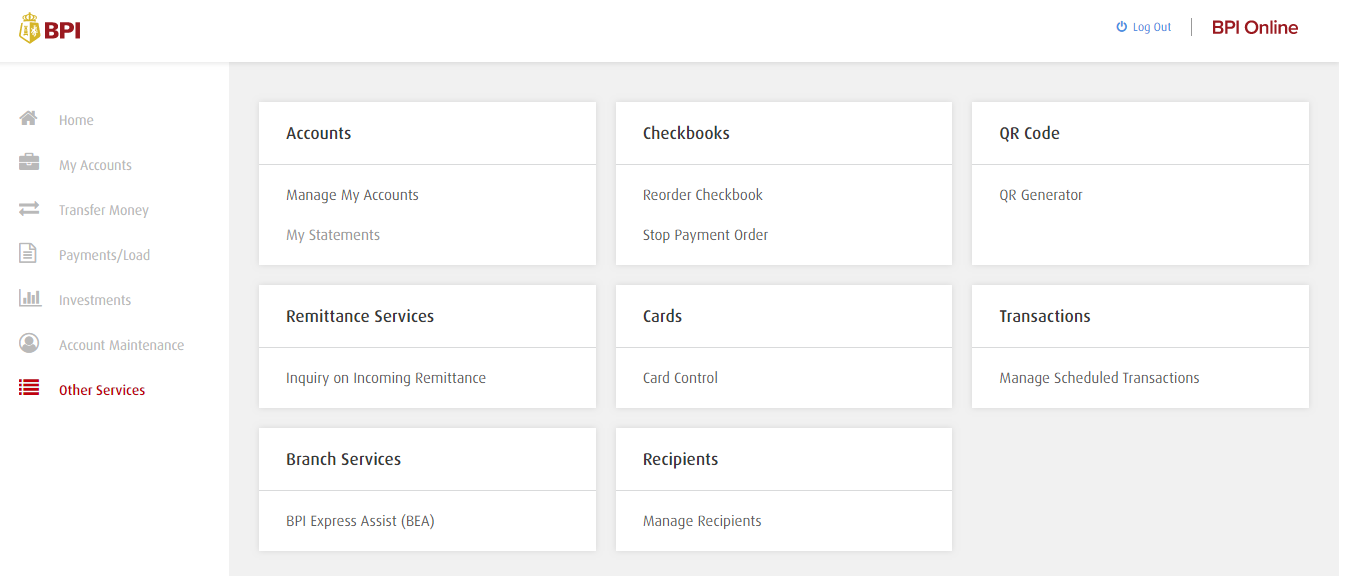

How to get an Online Bank Statement

I always recommend a bank where you can access it online, so wherever you are if you need proof of financial capacity, you can show it to the embassy. Here’s how to see your Online Bank Statement.

Since I have a BPI account, the screenshots will mostly be about it. However, the concept is still the same on some banks.

Go to the website where you can access your online account if you haven’t, you better register. (For BPI it’s bpi.com.ph)

Log-in to your account.

Go to other services > Statements

Choose which account you want a statement from and what date. Click Download.

Now you can have your online bank statement.

You can print that, though the original is much more authentic and better. If you are abroad, you can ask a letter from your bank certifying the authenticity of the statements, or every page of the statement has the bank's official stamp.

Tips on getting Bank Certificate and/or Bank Statement

You can get both your Bank Certificate and Bank statements on the same day.

Fees may differ for a Bank Certificate and a Bank statement

If you can’t get your Bank Documents in the Philippines, you can Authorize a person to get it for you; you need to make an Authorization letter as well as give a photocopy of your ID to the one you authorized to claim

If you are out of the country, you might need to e-mail the bank on how to get a Bank Certificate while you are there or how to get your Bank Statement authenticated

How to get your visa Approved with a Bank Certificate and/or Bank Statement tips

Here are 7 practical tips on how to have the right "show money" for your visa applications

You need to have a good ADB (Average Daily Balance) for your Bank Certificate. It can make or break your visa application. A great ADB will have more than half of your ending balance if your ADB is very low than it might mean you suddenly deposited a big amount of money, and it will be suspicious. The embassy will think that it’s borrowed and isn’t yours. An Example: you have 10,000 on January – November, and it suddenly went up to 120,000 to December – your ADB might be 20,000 which is very low to your ending balance of 120,000.00 Now if you have deposited 10,000 a month then ADB would probably be about 65,000, and it’s okay. Be always careful of that one.

Make your account active; it would be good if there are withdrawals and deposits on your Bank statements; that would mean you are actively using your account

Photo by Fabian Blank

Bank Certificates or Bank Statements are popular requirements for Tourist Visa Applications. I hope with this article you have learned the difference between the two and don’t get scared of getting those as they are easy to apply for. If you don’t have a bank account, it doesn’t mean you can’t have a visa; here are tips on how to apply for a visa if you don’t have a bank account.

Alternatively, you could open a bank right now, here is another article on the best bank account for traveling abroad. Happy Banking!

Click this for the Directory of Visa Applications Guides & Tips For Filipinos

Are you on Pinterest? Pin these!

![How to Use Instagram to Promote Your Travel Blog & Earn Money [Digital Marketing Tips]](https://images.squarespace-cdn.com/content/v1/5806a87f6a4963c2ddce112c/1584528831807-78QSGIBZEOOQLPGIPPPF/image-asset.jpeg)